Market Structure

The network coordinates the ecosystem of users, hardware teams, and infrastructure operators with cryptoeconomic incentives. Permissionless participation in the protocol catalyzes a global-scale infrastructure buildout that drives down the cost and latency of zero-knowledge proof generation for all.

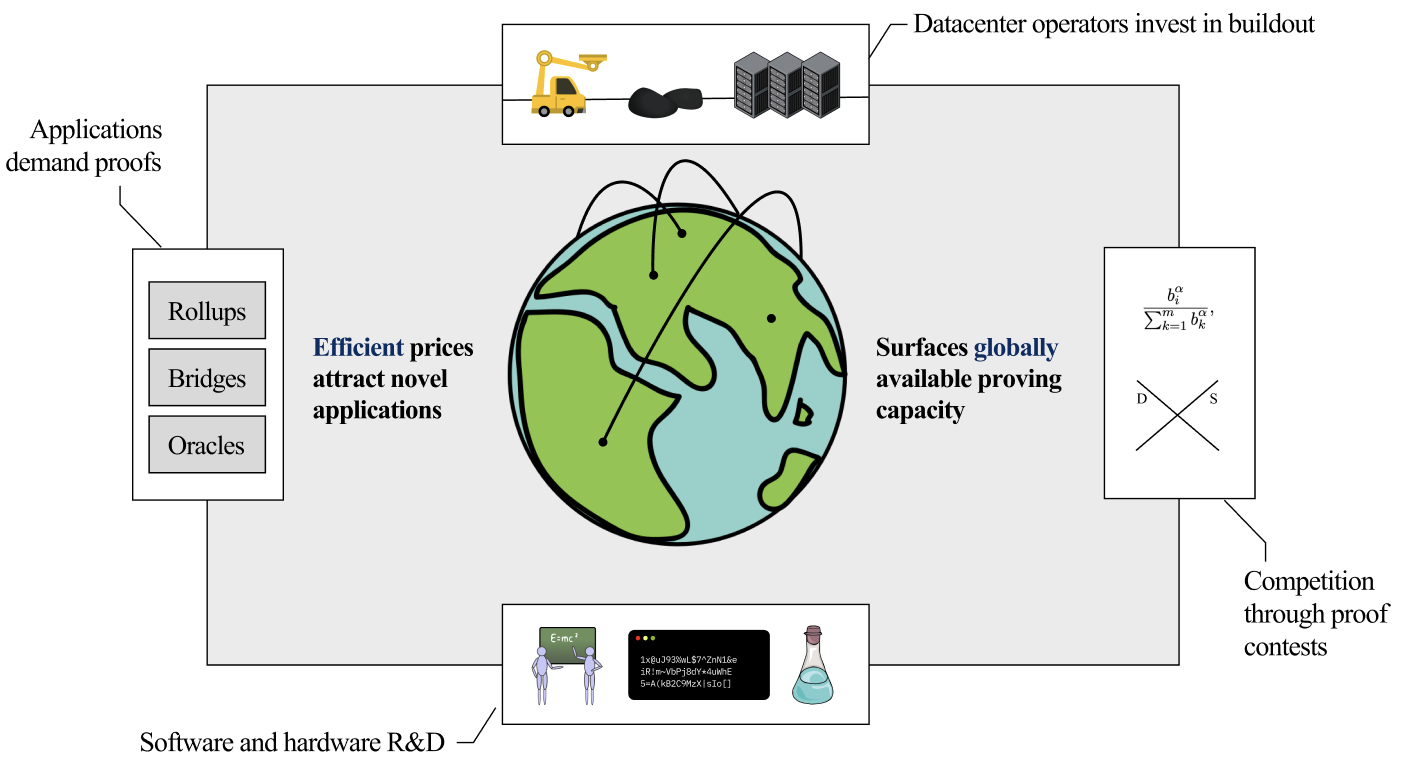

There are two primary participants in the network: requesters, which are applications that demand ZK proving, and provers, who provide proving capacity and infrastructure. The network induces a market structure with a virtuous flywheel by aggregating supply and demand. This incentivizes global scale competition for developing increasingly efficient proving infrastructure. Tight integration with SP1 development and the network also ensures that technological and algorithmic advances in proving can quickly accrue to users.

The Virtuous Flywheel

The free market for proving induced by the network aggregates demand across many applications and supply across many provers. This has the following implications:

1. A unified request experience means more efficiency: Without the aggregation of supply and demand, it is likely that the market for proving degenerates into applications and provers making bespoke agreements or applications setting up in-house infrastructure. Over the long run, application teams may not be well-positioned to run their own proving infrastructure due to the specialized operational and technical skills involved. Over-the-counter deals are not efficient and lead to frictions in the market. A transparent market with a unified protocol for pricing proofs provided by an aggregated supply chain reduces integration time, development cost, and generates efficient prices.

2. Transparent pricing accelerates infrastructure: With transparent pricing and aggregated demand, provers face economics that are far easier to forecast. Provers can build out infrastructure faster and with more certainty because their cash flows are more predictable. The existence of a transparent market for proving means that provers’ risks can be priced and financed efficiently.

3. Home provers with low cost of capital can form proving pools: The protocol allows for anyone in the world with spare proving capacity to join. Often, individuals with home GPUs and hardware have far smaller capital costs due to spare capacity and lower operational costs due to cheap electricity than larger operators. By allowing home provers to participate, proving capacity can be dramatically increased and efficient prices can be maintained. This also allow for the formation of proving pools, which is a set of provers that pool their capacity together to jointly bid in the proof contest mechanism.

4 Permissionless participation encourages prover decentralization: Because entry into the market from both sides is permissionless, the frictions for joining and beginning to provide proving capacity are minimized. This allows provers to join from anywhere, enabling decentralization. In contrast to a marketplace where only certain actors can participate, this means that downstream users and applications can reliably receive proofs and are not bottlenecked by provers in a particular location.

The Network Incentivizes Global-Scale Competition

The network induces competition on proving and incentivizes a broad, distributed prover set, ensuring that applications that require high reliability and liveness are able to receive proofs for minimal cost. Provers compete in auctions to minimize proving costs; these auctions can be simple reverse auctions, which awards proofs to the lowest bidder, or proof contests, which award proofs to one of the lowest bidders to encourage decentralization.

1. Auctions enable competition between provers: The auctions, whether implemented as simple reverse auctions or proof contests, are designed to enable provers anywhere in the world to participate in the network while competing on proving costs. This is achieved by asking provers to bid in auctions to be able to receive fees set by users. These auctions surface price signals by adjusting their fees to find market clearing prices for proofs.

2. Price discovery allows for reinvestment: Auctions pay out a large share of fees set by users to provers that perform their core task well: efficiently generating low-cost ZK proofs within a user-specified deadline. This allows returns from the auctions to be reinvested in better proving infrastructure and algorithmic and hardware improvements in proving. Provers are incentivized to continually improve their proving infrastructure. Proving pools can also provide smoothed fees to individual provers, allowing them to participate in the network in a “plug-and-play” fashion.

3. Gains from competition accrue to applications: End users are the primary beneficiaries from competition between provers. Over time, provers directly compete with each other on the main feature that users demand: low cost proofs delivered within user-specified deadlines. Importantly, there are applications that require proofs to be delivered at low costs to be viable at scale. The network uses free market competition to serve these applications.

Note: More details about the market structure are available in the whitepaper.